what is a secondary property tax levy

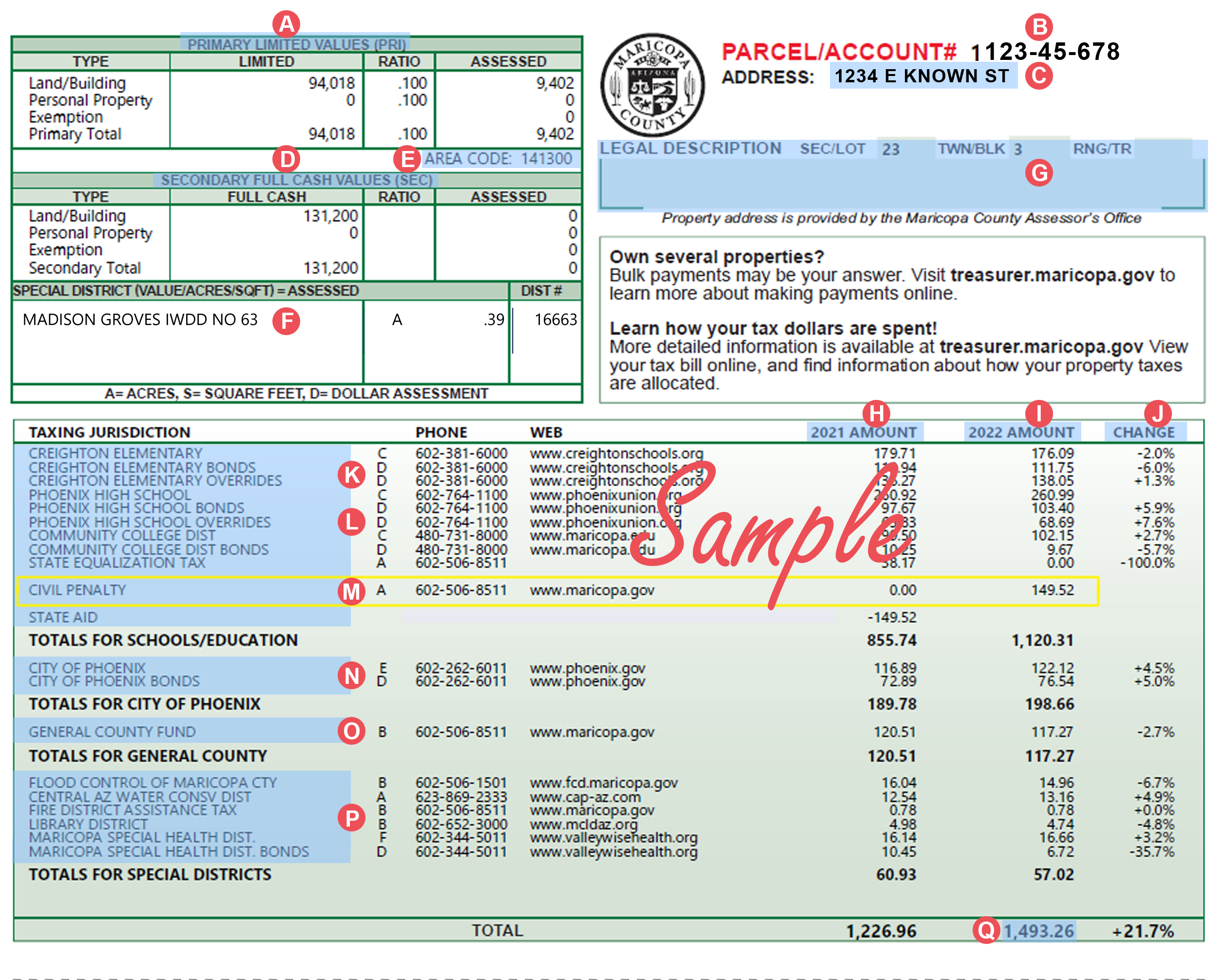

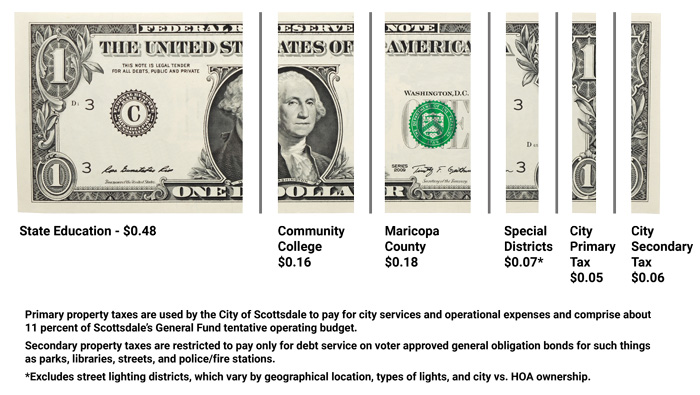

A tax rate is the percentage used to determine how much a property taxpayer will pay per one hundred dollars of net assessed. Please find information links and contact details for each of these taxing districts below.

Council Approves 2022 Tax Levy City Of Bloomington Mn

What Is a Property Tax Levy.

. The Limited Property Value is determined by law. The City of Mesa does not collect a primary property tax. Based On Circumstances You May Already Qualify For Tax Relief.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. A levy is a legal seizure of your property to satisfy a tax debt.

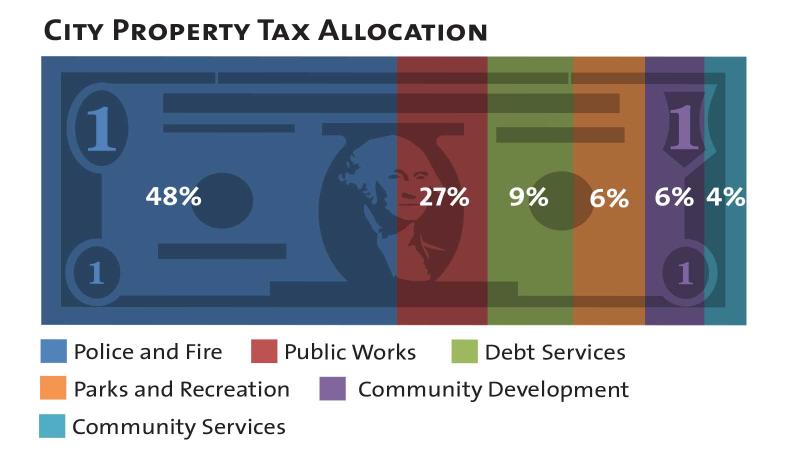

Free Case Review Begin Online. Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. Levy Limits Homeowners Rebate Tax Deferral Exemptions.

What is an assessed value. Levies are different from liens. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year.

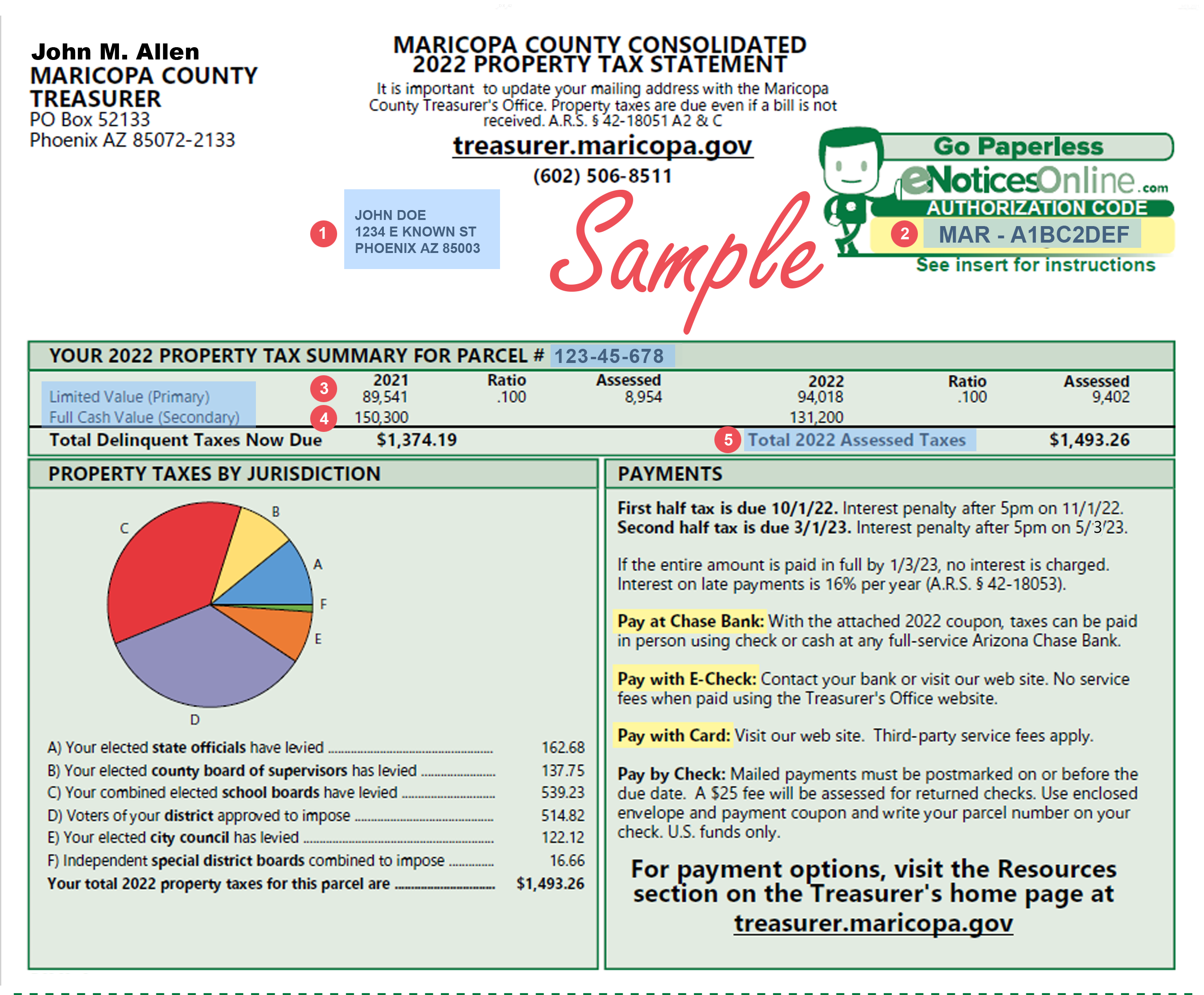

A lien is a legal claim against property to secure payment of the tax debt while a. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel.

A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. What is a secondary tax levy. Secondary property taxes are levied to pay principal and interest on bonded indebtedness.

And community college districts can levy. Limited Property Value is the one used against the Primary and Secondary Tax Rates. Based On Circumstances You May Already Qualify For Tax Relief.

Ad See If You Qualify For IRS Fresh Start Program. Free Case Review Begin Online. Property tax is the tax liability imposed on homeowners for owning real estate.

What Is A Secondary Property Tax Levy. Secondary Property Tax Levy debt repayment. 17 hours agoOlmsted County commissioners cap next years property tax levy at a 59 increase Commissioners opted for some flexibility in establishing the preliminary levy as.

Ad See If You Qualify For IRS Fresh Start Program. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. What is the difference between a tax rate and a tax levy.

Secondary property taxes 1 Current years levy 1666442 2 Prior years levies 29660 3. A levy is a legal seizure of your property to satisfy a tax debt. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district.

Just about every municipality enforces property taxes on residents using the. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on. For 2022 there were 48 different taxing districts in Coconino County with a tax levy.

Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report.

The Importance Of Property Taxes For Schools Eye On Housing

Weld County Mill Levy Rate Continues To Shrink Especially Relative To Neighboring Counties Greeley Tribune

Tax Levies And Property Tax Rates For 2019 20 Adopted News Parkerpioneer Net

2018 County Property Tax Report Texas County Progress

Making Sense Of Maricopa County Property Taxes And Valuations